Remittance

Global Adoption of CBDCs & Its Impact on Cross-Border Transactions

The adoption of CBDCs is rapidly gaining momentum on the global stage. In an era defined by rapid digitalization and evolving financial landscapes, Central Bank Digital Currencies (CBDCs) have emerged as a catalyst in the world of finance. As the name suggests, CBDCs are digital representations of a country's official currency. The primary purpose of CBDCs is to offer a secure and efficient digital alternative to physical cash while leveraging the benefits of blockchain technology.

Impact on cross-border transactions:

In the IMF’s (International Monetary Fund) view, global coordination becomes paramount to ensure the successful implementation of CBDCs and promote interoperability in domestic and cross-border payment systems. It is essential to prioritize having open and regular dialogues between central banks and the private sector about their CBDC journey and experiences.

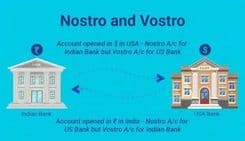

The impact of CBDCs on cross-border transactions is profound and multifaceted. CBDCs have the potential to significantly enhance the efficiency and speed of cross-border transactions. Traditional international payments often involve multiple intermediaries, resulting in delays and added costs. With CBDCs, transactions can occur directly between central banks, reducing the need for intermediaries and accelerating settlement times. Also, cross-border payments have long been associated with high costs, including currency conversion fees and intermediary charges.

To ensure the successful implementation of Central Bank Digital Currencies (CBDCs), it is crucial to prioritize several key principles. These include alignment with national laws and regulations, encouraging regulatory cooperation and information sharing among relevant authorities, safeguarding consumer interests through transparent frameworks, and upholding user privacy and data protection, including the right to be forgotten, while adhering to data protection laws and consent-based data usage. These principles collectively promote the effective and secure integration of CBDCs into the financial ecosystem.

Key challenges:

Despite their potential benefits, CBDCs also pose challenges for cross-border transactions. One key challenge is ensuring interoperability between different CBDCs and existing payment systems.

Interoperability: Developing standards for interoperability between different CBDCs and existing payment systems is crucial to ensure smooth cross-border transactions.

Cybersecurity: Implementing robust cybersecurity measures to safeguard CBDC transactions against cyberattacks and data breaches.

Regulatory administration: Addressing potential regulatory governance and security concerns is crucial for the successful implementation of CBDCs in cross-border contexts.

Counterfeiting: Developing secure digital features to prevent counterfeiting of CBDCs.

Resilience: Ensuring the resilience of CBDC systems to prevent disruptions and maintain trust in the currency.

Future implications:

In the dynamic landscape of cross-border trade, Central Bank Digital Currencies will play an instrumental role in shaping the future of transactions. As more countries launch their digital currencies and explore cross-border integration, several key future implications emerge:

Reshaping international finance: CBDCs have the potential to reshape the international financial landscape, challenging the dominance of traditional currencies and payment systems.

Financial inclusion: The widespread adoption of CBDCs can extend financial inclusion to marginalized populations, promoting economic growth and stability.

Regulatory harmonization: The need for regulatory harmonization and international cooperation will become increasingly evident as CBDCs cross border

India’s CBDC initiative:

Countries worldwide have been pursuing Central Bank Digital Currencies for various reasons. Prominent among these motivations are financial inclusion and security, along with the desire for greater control over their currency in an increasingly digital era of payments.

India, in particular, has taken significant steps in the CBDC realm. The Reserve Bank of India (RBI) has plans to introduce its CBDC in the call money market, intending to utilize CBDCs as tokens for call money settlement. Currently, in a pilot phase across both retail and wholesale segments, India's CBDC initiative has set an ambitious target of achieving one million transactions a day by the end of 2023. This move reflects India's commitment to harnessing CBDCs to enhance financial inclusion, security, and control over its currency in the evolving landscape of digital payments.

Conclusion:

The journey of CBDCs is just beginning, and the long-term implications are profound. As businesses adapt to this changing financial terrain, they will have the opportunity to harness the benefits of cost-effective cross-border transactions.

However, amidst these opportunities, they must navigate a complex web of regulatory nuances. According to the whitepaper published by the Central Bank Digital Currency Global Interoperability Principles, to truly unlock the potential of CBDCs in cross-border contexts, promoting regulatory consistency and clarity across jurisdictions is paramount. Policymakers must collaborate to create an enabling environment that not only supports seamless domestic and cross-border transactions but also ensures compliance with essential anti-money laundering (AML) and know-your-customer (KYC) requirements.

By adopting a globally coordinated approach, we can facilitate the smooth flow of funds, enhance financial inclusivity, and contribute to the advancement of the digital economy. In this journey, CBDCs stand as a transformative force, driving innovation, efficiency, and connectivity in the world of international finance.