Remittance

What Is the Role of IBAN in Exports?

Did you know you need an International Bank Account Number (IBAN) to accept international payments from India? Exporters have an edge regarding the schemes, resources, and facilities they receive, but they must also fulfill many formalities.

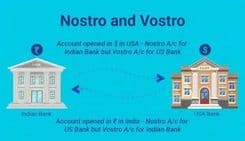

Along with IBAN, you also need to understand the difference between Vostro and Nostro accounts to set the payment mechanism in place for exports and imports. IBAN is critical for exports as it facilitates quick and secure international transactions.

- Also Read: Importance of purpose code

This article will dive deep into the intricacies of IBAN and the role it plays in the export business.

What is the purpose of IBAN?

IBANs are used to identify the bank accounts into which the amounts are to be deposited for cross-border transactions.

What is the general format of IBAN?

Generally, IBANs can consist of up to 34 numbers, characters, and letters, with each representing a particular detail about the bank. Each of these numbers, alphabets, and characters will help identify the bank name, country, bank branch, account details, and the check number.

Where can one find the IBAN number?

In general, you will find the IBAN number on the top right corner of your bank statement or RIB. In case you do not find it there, then you can get it through your bank’s IBAN calculator tool or the bank’s internet banking service.

What is the role of IBAN in exports?

Let’s take a look at the role IBAN plays in international trade and why it is considered critical for exports.

IBAN helps with international payments

IBAN makes sure payments from global customers are routed to the recipient’s bank account without any errors or delays. Exporters leverage IBAN to get payments directly from their global customers into their bank account.

Use IBAN to ensure accurate transactions

With IBAN it standardizes the format and makes it easier to avoid the errors that may occur due to manual entries. Since IBAN has details around the bank, account number, and country details, it enables banks to process payments efficiently.

IBAN enables quick payment processing

IBAN offers a standardized format to enable the validation and processing automatically and speeds up funds transfer. Exporters will benefit due to the improved cash flow due to the quicker receipt of funds.

Leverage IBAN to meet compliance needs

Based on international banking regulations, IBAN is a necessity to meet compliance requirements in many financial institutions and some countries. By meeting the applicable compilable requirements, exporters can avoid any penalties that come due to non-compliance.

Optimize transaction costs with IBAN

Avoid any errors or missing information during the payment process. This will help you avoid corrections, rejections, or additional charges. IBAN also ensures complete and correct banking details.

Use IBAN for availing trade finance

IBAN is considered a necessity in many instances to avail trade finance options as it facilitates funds disbursal or payments from banks and various buyers.

What are some IBAN-related best practices for exporters?

- Exporters must share the IBAN details with global buyers so that they can avoid delays in receiving payments from them

- Always check and verify the IBAN format with your bank to ensure that all details are complete and accurate

- Under SEPA (Single Euro Payments Area) in Europe, IBAN has become mandatory to get payments in many regions

As an exporter, the main pillars of your business includes sound financial operations for inward remittance, trade finance, banking regulations, and a robust cash flow. IBAN is one of the factors that will facilitate this process by increasing efficiency, simplifying processes, and ensuring compliance.

A smart and innovative inward platform like LeRemitt can help you with many aspects by ensuring speed, transparency, and security. At LeRemitt we offer you many other solutions to ease your export operations. Want to learn more? Click here to talk to our expert team!